- info@kaizencpa.com

- Our Office: USA - Hong Kong - Shenzhen - Shanghai - Beijing - Taiwan - Singapore - Japan - UK

Search for anything.

Knowledge

- Home

- Knowledge

- Introduction and Issuance of Uniform Invoice (Part II)

2023-11-08Introduction and Issuance of Uniform Invoice (Part II)

The purpose of this article is to introduce Taiwan uniform invoice and instruct how to issue.

The introductions as below:

1. Category of uniform invoice

2. Principle of issuance

3. How to issue a handwritten invoice

4. How to deal with the wrong uniform invoice

The article is divided into two parts for readers’ convenience to understand.

3. How to issue a handwritten invoice

4. How to deal with the wrong uniform invoice

The introductions as below:

1. Category of uniform invoice

2. Principle of issuance

3. How to issue a handwritten invoice

4. How to deal with the wrong uniform invoice

The article is divided into two parts for readers’ convenience to understand.

3. How to issue a handwritten invoice

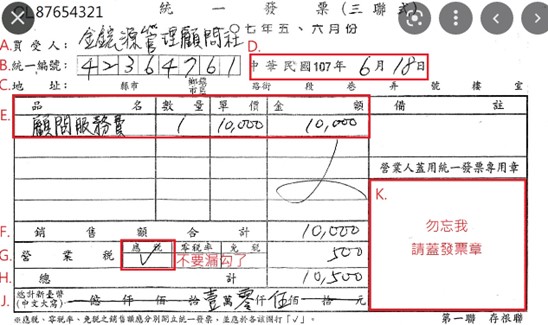

Computation of tax rate

Tax: Tax included÷ 1.05× 0.05

Ex: Total amount is TWD10,500. The tax will be 10,500÷1.05*0.05=500.

That is, the sales amount is 10,500-500=10,000

Tax TWD500

Total TWD10,500

In the condition of the result with decimal point, please round it up to the integer.

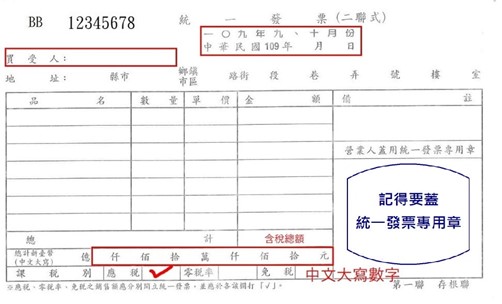

Duplicate Form

Triplicate Form

The difference between duplicate and triplicate form as below:

(1.) The piece of duplicate form is two pieces in total.

(2.) The amount is all included tax.

(3.) The column of “Total” only.

The duplicate form is usually issued to an individual (B to C); triplicate form is usually issued to the company with uniform invoice number (B to B).

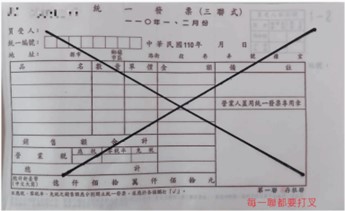

4. How to deal with the wrong uniform invoice

In the condition of issuing of an invoice with errors, including uniform invoice number, amount, description, it shall be dependent on if such invoice was sent over to the receiver and was declared the business income tax to deal with.

(1)

Unfulfillment of delivery and declaration

Write the word “Annulled” on the invoice and fold it up directly.

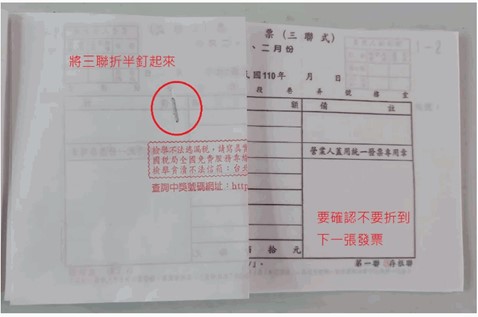

(2)

Fulfillment of delivery but declaration

Contact the client to send the original copy back. After the original copy is received, folding and stapling it with the restored copy together and noting it as “Annulled”.

If it is unable to reach the buyer, especially for the uniform invoice in duplicate form, the application form can be submitted to Taxation Bureau to inform this situation. Please be noted that this condition is not allowed to be occurred more than three time at one year.

(3)

Fulfillment of delivery and declaration

Due to the business income tax declared at this term, it has no choice but notify the client that the sales allowance will be issued at the next term. The original copy of sales allowance shall be delivered to the client.

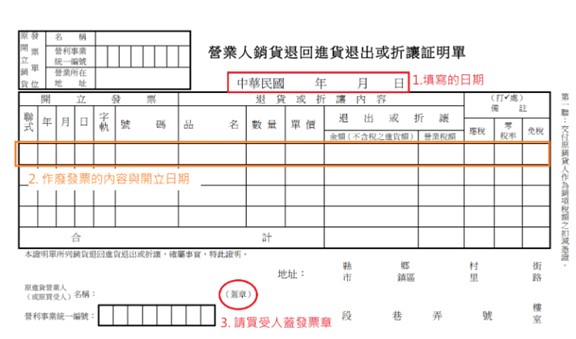

The example of issuance of sales allowances as following:

Disclaimer

All information in this article is only for the purpose of information sharing, instead of professional suggestion. Kaizen will not assume any responsibility for loss or damage.

WhatsApp/Line/Wechat: +852 5616 4140

All information in this article is only for the purpose of information sharing, instead of professional suggestion. Kaizen will not assume any responsibility for loss or damage.

WhatsApp/Line/Wechat: +852 5616 4140

Related Posts

Brief Introduction to Taiwan's Salary and Welfare System

Taiwan has a comprehensive labour law system, which aims to protect the basic rights and interests of workers while promoting the harmonious development of labour-management relations. The following will elaborate on Taiwan's salary and welfare service system from key aspects such as wages, working hours, and leave and recreation.

Taiwan (ABTC) Application Introduction

To promote the development of economic and trade activities in the Asia-Pacific region and to deepen business ties in the region, the APEC Business Travel Card Program (APEC) provides expedited entry and exit for business visitors who need to frequently travel across the Asia-Pacific region for short-stay business trips without having to go through complex immigration procedures for each trip.

Effectiveness of Taiwan Tax Notice Delivery

If you have not received the tax bill in Taiwan, does that mean you do not have to pay the tax? A reminder to everyone, tax bills are sent via registered mail. If the mail is not collected and the post office retains it, it is still considered delivered under the law even if you did not actually receive it.

Taiwan Individual Overseas Investment Tax Guide

Taiwanese individuals who invest in overseas financial products or real estate must file an Alternative Minimum Tax (AMT) return if their total annual foreign-source income exceeds TWD1,000,000 and their basic income surpasses the exemption threshold (TWD 7,500,000 for the 2024 tax year). It is important to note that different types of income, such as capital gains and interest, are categorized seperately and cannot be aggregated for tax calculation purposes.