- info@kaizencpa.com

- Our Office: USA - Hong Kong - Shenzhen - Shanghai - Beijing - Taiwan - Singapore - Japan - UK

Search for anything.

Knowledge

- Home

- Knowledge

- Setting Up a Single Family Office in Singapore

2023-05-11Setting Up a Single Family Office in Singapore

Setting Up a Single Family Office in Singapore

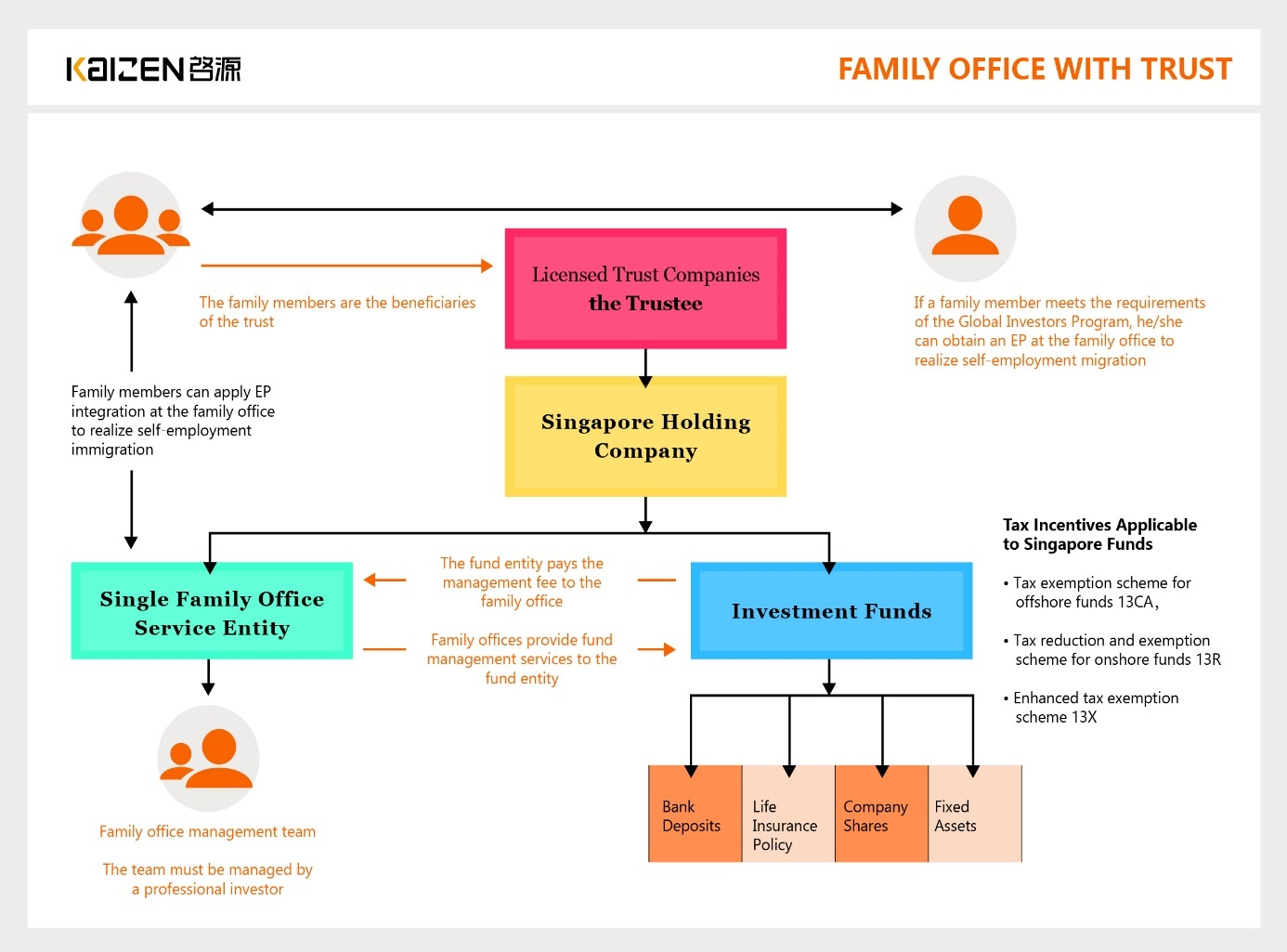

The Singapore government has set up tax incentives for offshore and onshore funds managed by family offices to boost Singapore’s appeal as a leading wealth management centre. Please refer to our Introduction to Family Office in Singapore for more details.

How to Set Up the Structure of a Single Family Office in Singapore?

A simplified description of the ownership structure of a typical family office is shown in the following figure:

How Long Will it Take to Set Up a Single Family Office?

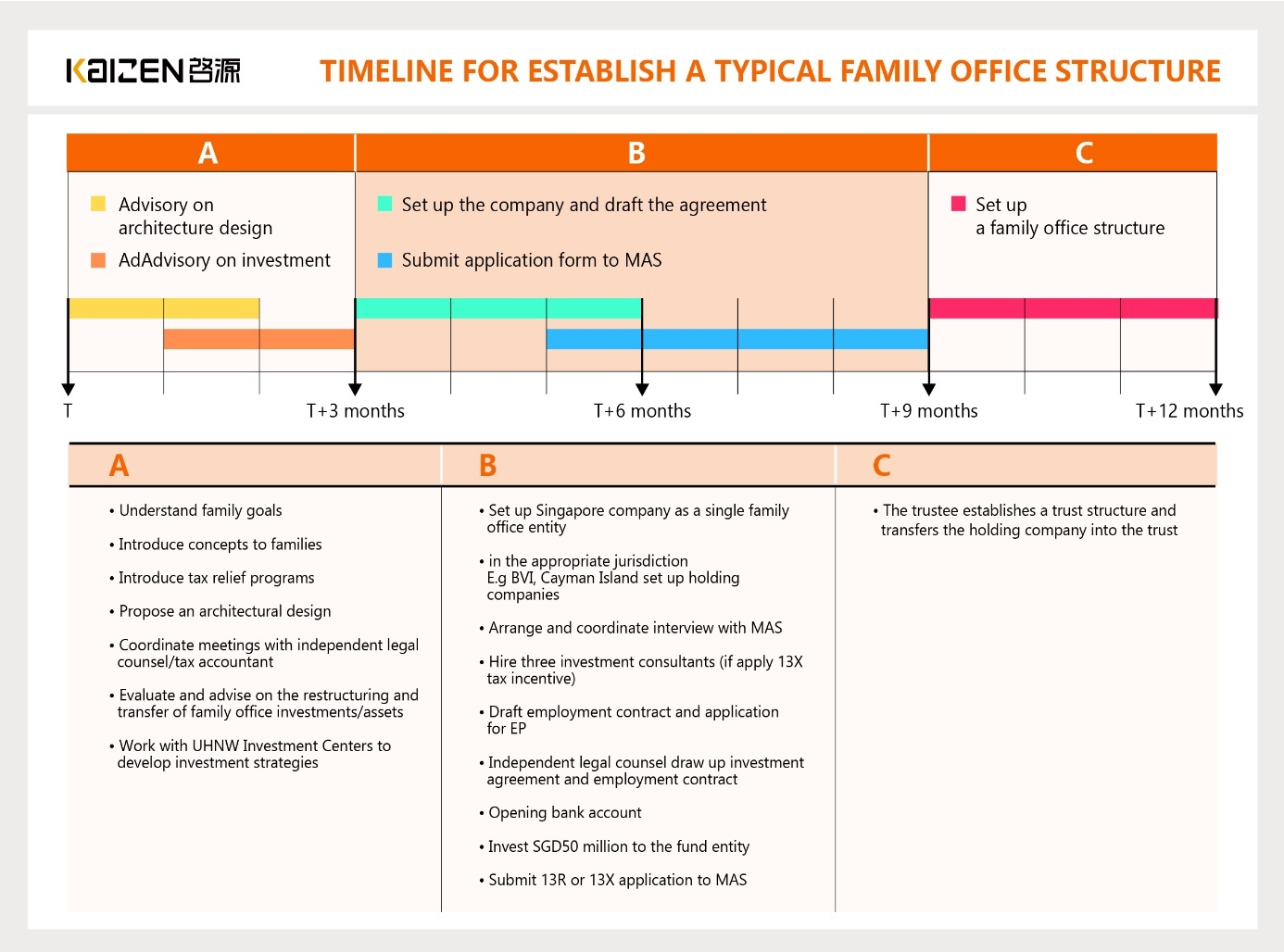

The timeline for setting up a single family office is shown below:

KAIZEN Group is equipped with experienced and highly qualified professional consultants and is therefore well positioned to provide professional advices and services in respect of the formation and registration of company, and application for various business licences and permits in Singapore. Please call and talk to our professional consultants for details.

Disclaimer

All information in this article is only for the purpose of information sharing, instead of professional suggestion. Kaizen will not assume any responsibility for loss or damage.

WhatsApp/Line/Wechat: +852 5616 4140

All information in this article is only for the purpose of information sharing, instead of professional suggestion. Kaizen will not assume any responsibility for loss or damage.

WhatsApp/Line/Wechat: +852 5616 4140

Related Posts

Guide to Singapore Company Registration

In today's increasingly fierce global business competition, enterprises are constantly seeking more favourable development environments. Singapore, with its stable political environment, low-tax policies, sound legal system, and highly internationalized financial system, has become one of the most attractive destinations for company registration in Asia.

Guide to Singapore S Pass Application

Singapore S Pass (“SP”) is a type of work visa that is designed for mid-skilled technical staff who wish to work in Singapore. Candidates need to earn at least S$3,300 a month and have the relevant work experience. You can apply for the Singapore SP if you are: A locally incorporated Singapore company and need to hire an employee from overseas; or You have an employment offer from a Singapore employer. In this case, your employer will make the SP application on your behalf.

Singapore GST Invoicenow Requirement

InvoiceNow is the nationwide e-invoicing network based on an international standard called “Peppol”. It was introduced by the Infocomm Media Development Authority (“IMDA”) in 2019. InvoiceNow enables businesses to easily send and receive invoices in a structured digital format. This digital invoicing method reduces the need for manual processing and recording of invoices in accounting systems, which helps businesses avoid tedious work and errors.

Singapore Central Registers of Nominee Directors and Nominee Shareholders

Effective 16 June 2025, all companies and foreign companies must submit information on nominee directors and shareholders, along with their nominators, to ACRA’s Central Registers by 31 December 2025, in addition to maintaining private registers. Any subsequent changes must be reported to ACRA within two business days. For entities incorporated or registered on or after 16 June 2025, this information must be provided at the point of registration.